Welcome to Part 1 of a 4-part blog series on Energy Investments.

Check back every few weeks for the next installment!

Introduction and Investment Basics

Even someone well-versed on energy and building management can find navigating the world of energy investment quite difficult. Before any thought of allocating capital, the energy manager must have familiarity with a wide range of Energy Conservation Measures (ECM’s) to consider. The energy manager then needs to find quotes to implement the various ECM’s and the possible rebates and tax incentives available. The savings from the ECM’s are even more complex. Reductions in utility bills depend on a wide array of factors many of which cannot be predicted ahead of time. For example, to calculating savings for the next five years will need to make assumptions about future utility rates. While rates generally go up, natural gas prices in the US have shown they can go down as well.

A complete explanation of every step of the ECM process is far beyond the scope of this blog post. The topics of valuing savings from HVAC, lighting, EMS and water ECM’s could each merit their own blog post. However, I do hope to give a clear framework on how to think about energy investment’s ROI regardless of the underlying technology. Understanding this framework will help not only maximize the investment’s value to the company, but also reduce energy and ultimately lead to a more sustainable enterprise. And as I will show, this framework can even be used for the astute home owner and their personal ECM’s.

Investment Basics: Stocks and Bonds

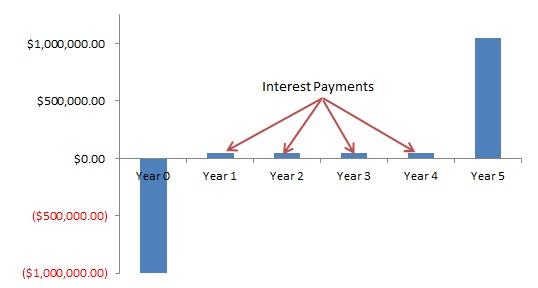

Hopefully without boring the MBA’s that are reading, I think it would be best to start with a brief overview of the basics of investing. The ultimate, basic investment is a very safe bond, which guarantees a certain percentage of interest for a certain time frame. The graph below shows cash going out of the investor’s pocket into the bond, with interest coming back in and finally principal at the end.

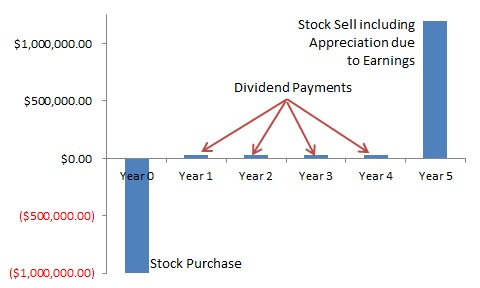

Stock cash flows can be much more complicated. The investor buys a stock at the initial price, receives dividends instead of interest, and eventually sells the stock at the final price. Stock prices can wildly fluctuate, but stock prices generally reflect their value as legal claims on a business. If the underlying company has more cash coming in than going out, the CFO at the company can either pay that cash back to investors through dividends, let that cash sit in the company’s bank account or invest that cash in a new venture. In the first case, the investor receives the cash just like it was interest. In the other two cases, the stock price increases since the value of the stock’s legal claim increased.

With either case, the basic principle is clear. People like having money now instead of later. Therefore, any company must “rent” the investor’s cash either through interest (with bonds) or through dividends and price appreciation (with stocks). This same concept will follow through with general capital investment and finally with ECM’s as I will show in the next three sections.

Coming in a few weeks – Part 2: Capital Investments