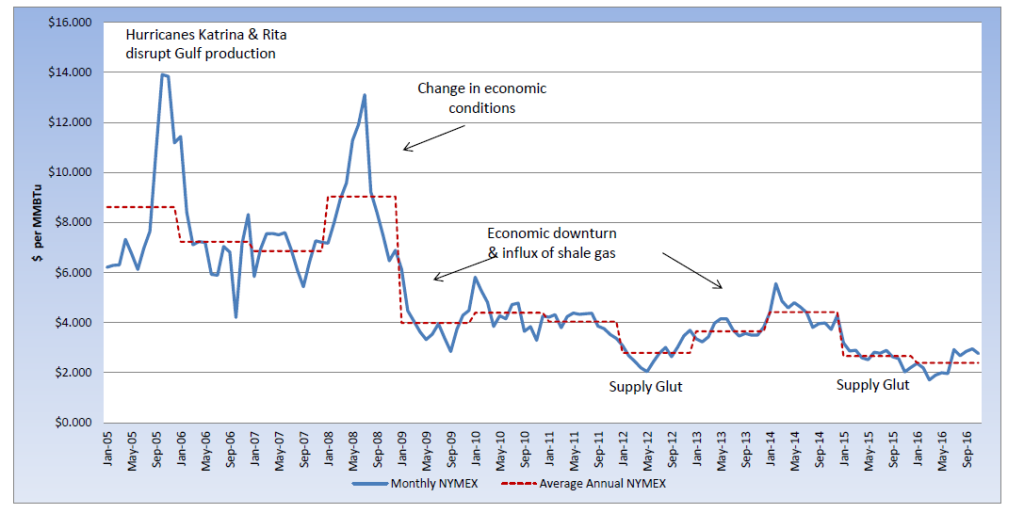

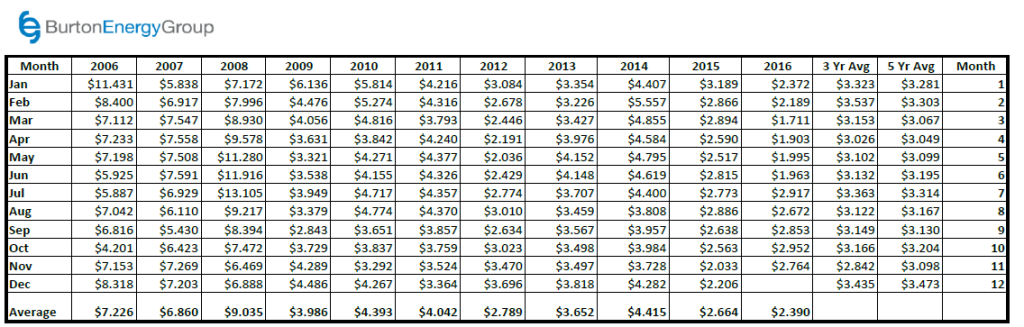

It looked as though the Chicago Bears and natural gas bears were abandoning us this fall, neither of which looking like they would be part of the conversation this season. While the Chicago Bears continue to sort out their quarterback situation and place hope back into Jay Cutler, the natural gas bears have returned with a vengeance and made themselves quite noticeable. After November set a one year high of $3.317 per MMBtu, it began declining as though it were on auto-pilot. The November contract settled at $2.764 per MMBtu, making the annual average $2.390 per MMBtu. The December contract moved into the prompt position at $3.068 per MMBtu and in its first four trading days, it has lost nearly 10% of its value. The lingering summer-like temperatures and forecast for above-normal temperatures through November have sent the natural gas market into a downward spiral. Natural gas storage is currently 1.3% above last year at this time and 4.9% above the five-year average for this reporting weak. The lack of heating demand is leading to continued injections, which will likely carry into November. Current predictions for the end-of-year storage level is now over 4.0 Tcf. The delayed start to winter, decreased demand and increased production is placing extreme bearish pressure on not only the natural gas market, but the electric markets as well.