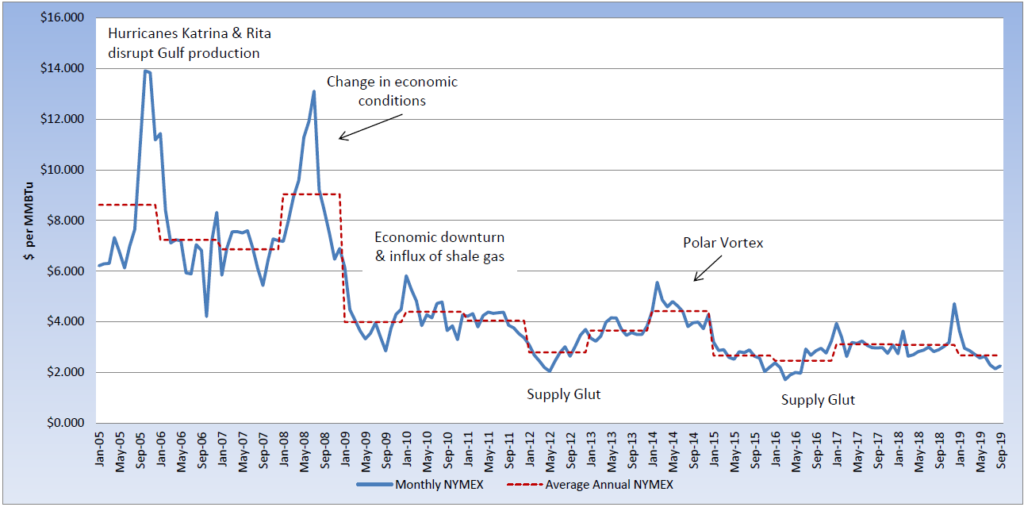

Natural gas has experienced an uptick in pricing, after experiencing multi-year lows in July, off the backs of record level production and average temperatures. The September contract rolled off the board at $2.251 per MMBtu, a 5% increase from the August settle. The October contract; however, has been on a run, rising more than 18% over the past month. Since bottoming out at $2.07 per MMBtu, the October contract has increased to $2.496, as of Friday’s close. As the market takes into consideration seasonal changes, much of the recent run-up in pricing is being attributed to market short-covering, as well as the limited demand impact from Hurricane Dorian, record-level liquified natural gas (LNG) exports, and above average temperatures in the forecast. Natural gas storage levels are currently 15% above last year’s level and 2.7% below the five-year average. After a brief drop in pricing from a bearish report, natural gas prices turned upward. The market still expects another 9 – 10 weeks of injections; however, due to expected demand and weather forecasts, the remaining injections are expected to be at average levels.