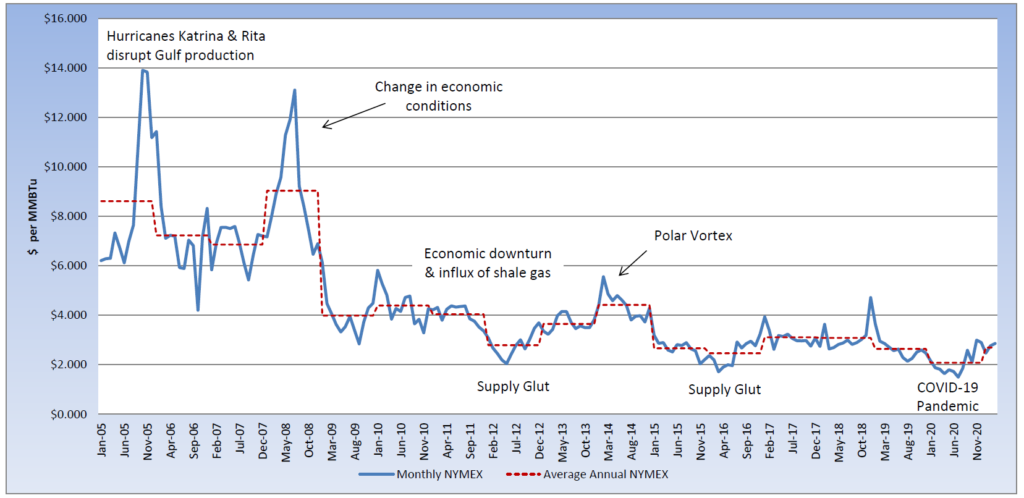

After polar vortex conditions overwhelmed Texas and the central U.S. during mid-February, electric and natural gas prices are returning to previous levels. While the daily market experienced the bulk of the volatility, forward electric and gas prices did feel the bullish pressure from an unprecedented week of weather, demand, and outages. The March contract settled at $2.854 per MMBtu, similar to where it began trading when it moved into the prompt position. The April contract has declined in the past week, recently settling at $2.662 per MMBtu. The U.S. Energy Information Administration (EIA) reported a withdrawal of 98 Bcf for the week ending February 26th, which was much more bearish than the market was expecting. Analysts were anticipating a triple-digit withdrawal and falling short of expectations pushed natural gas prices lower. The Northeast is currently experiencing some of its warmest temperatures and with Spring technically starting next week, the market is shifting its focus to warmer temperatures and reduced natural gas demand for heating. Natural gas prices are expected to continue trading in a range from $2.35/MMBtu to $3.06/MMBtu, according to analysts, with $3 remaining as the ceiling, for the near term. The market continues to consolidate near $2.66 per MMBtu, but a push above $2.70 per MMBtu could bring about more bullish pressure, while a drop to $2.60 per MMBtu could trigger more bearish pressure. The reaction of traders to rising demand for LNG could be what sways this market.