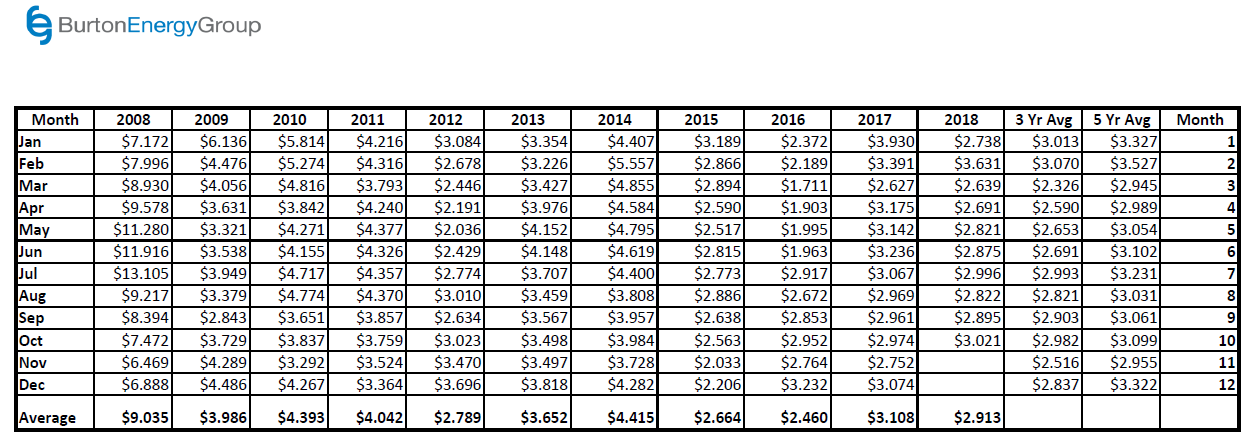

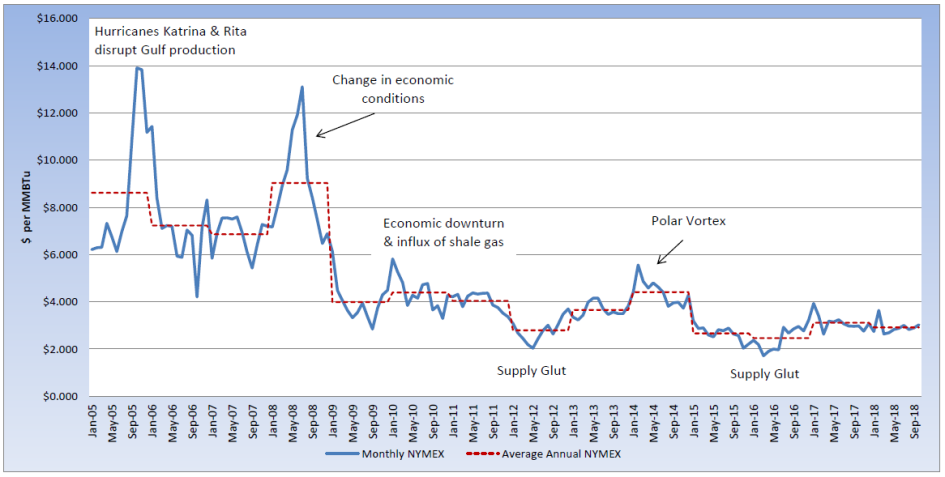

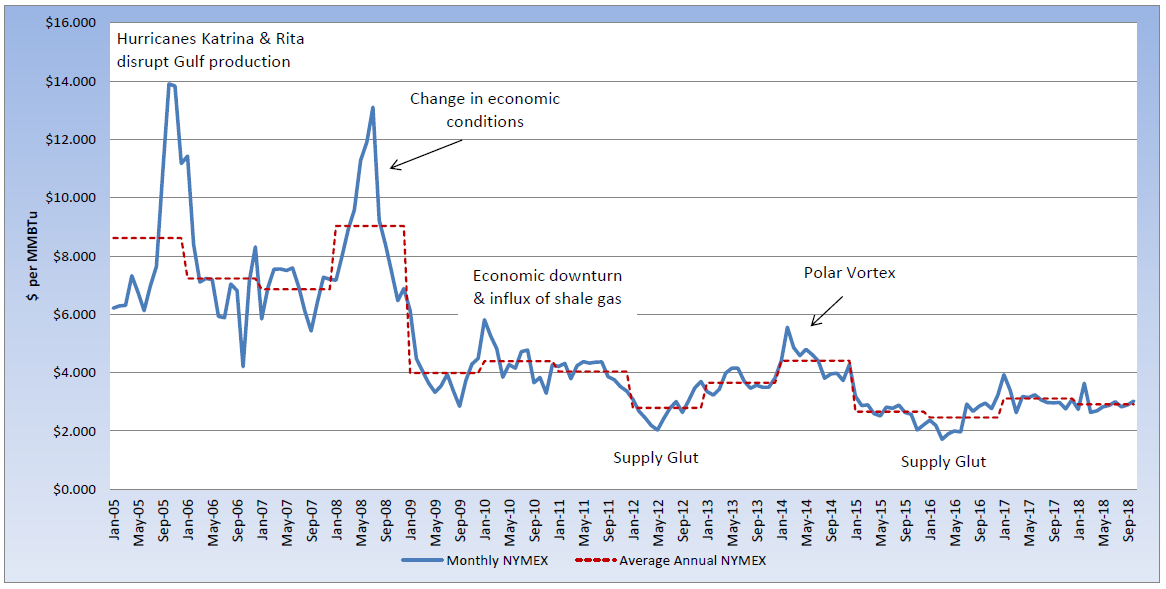

The bulls have come off the bench and taken control of the natural gas market in recent weeks. After dipping below $2.80 per MMBtu, early in the month, the October contract rolled off the board at $3.021 per MMBtu. This was only the second month to settle above $3.00 per MMBtu during 2018, which moved the calendar-year average to $2.913 per MMBtu. Momentum has carried and the November contract is currently trading near $3.25 per MMBtu, after pushing to an eight-month high of $3.368 per MMBtu earlier this month. Natural gas storage remains 17% below the five-year average, for this time last year. This past week’s injection was slightly above market expectations and halted the bull’s run, pushing pricing slightly lower, specifically for the prompt month. The U.S. is getting it’s first cooldown this week, with lows reaching the 20s to 40s. The market will be watching the impact these cooler temperatures have on heating demand, as well as the change in demand and production from Hurricane Michael. While long-term pricing continues to remain competitive, the market is expecting continued near-term volatility as we move closer to winter.