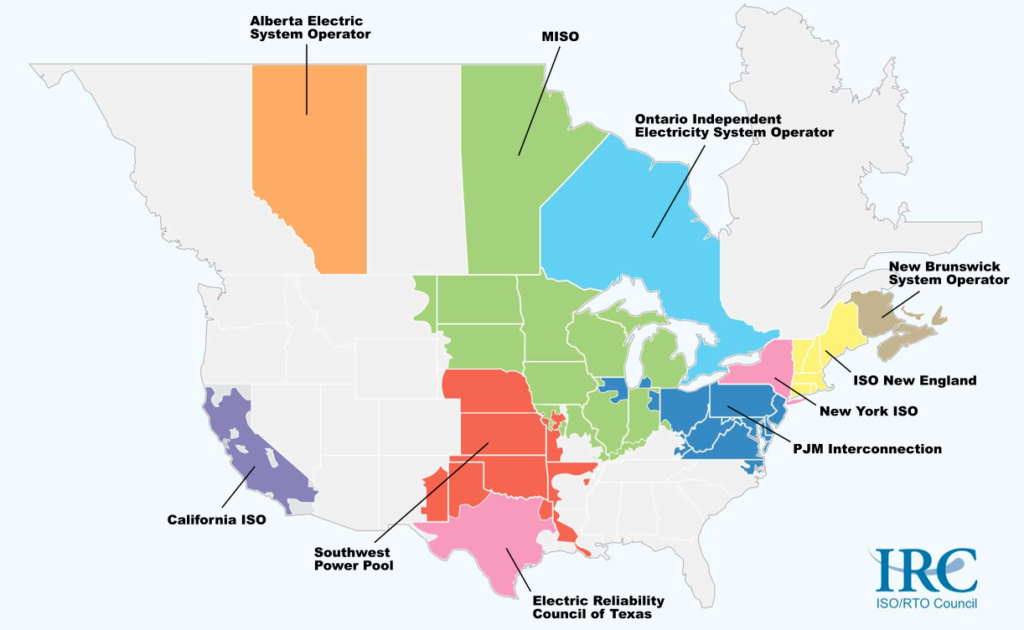

An electric supply rate is made up of multiple components. The cost of energy makes up the largest component, but the cost of capacity can be the second greatest cost component. In many deregulated markets, a capacity market exists, to ensure that there is enough generation on the grid to meet peaking demand on the hottest and coldest days of the year. These capacity markets exist behind most utilities located across Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, the District of Columbia, Massachusetts, New York, Connecticut, Vermont, New Hampshire, Rhode Island, and Maine. The cost of this capacity is determined through an auction process, in most cases. Generators bid their available generation into the auction, to guarantee it will be available during peaking times, and they are paid the settled auction price for that generation. In a sense, it acts as an insurance premium to customers, to eliminate the potential for blackouts, caused by a lack of generation available.

In order to determine how much capacity each account is responsible for purchasing for one year, the utilities review when their grid peaked during the previous summer. The utilities located in Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and the District of Columbia, look for the 5 hours during the summer that the grid peaked. For each account, the utility takes an average of the peak demand for those five hours, it is then multiplied by a few market factors, and the utility assigns the account’s capacity requirement. Other utilities will capture your peak demand for only one hour of the grid peaking, instead of the five-hour average, but it is also multiplied by market factors to set the account’s capacity requirement. This is often referred to as your “cap tag” or your “peak load contribution (PLC)”. Your cap tag is then multiplied by the auction price, to determine what your account owes for the cost of capacity. In deregulated markets, some customers take this cost a pass-thru from their retail electric supplier, while others prefer to bundle it into a fixed price on their contract.

Customers have the ability to impact their capacity requirement each summer. Burton offers the option to its customers to sign up for potential peak-day alerts. During the summer, when the grid has the potential to set a peak hour, Burton will alert the customer with an email the day before. This allows customers to curtail their load during those potential peaking hours. Permanent offsets, like energy efficiency upgrades or updates, can also help reduce peak demand. The Demand team at Burton has the experience needed to help customers identify these opportunities. Working with an integrated partner like Burton, allows customers the opportunity to manage their energy usage, reduce peak demand, and incorporate these efforts into electric supply contract opportunities, to maximize the savings benefits.

If you are interested in learning more about any of Burton’s services, please visit our website and reach out to Blake Brewer.