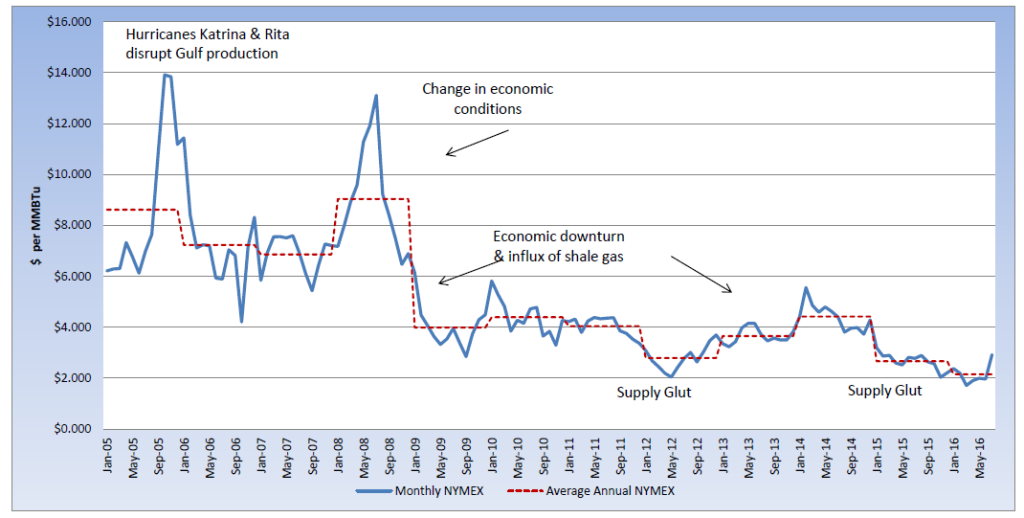

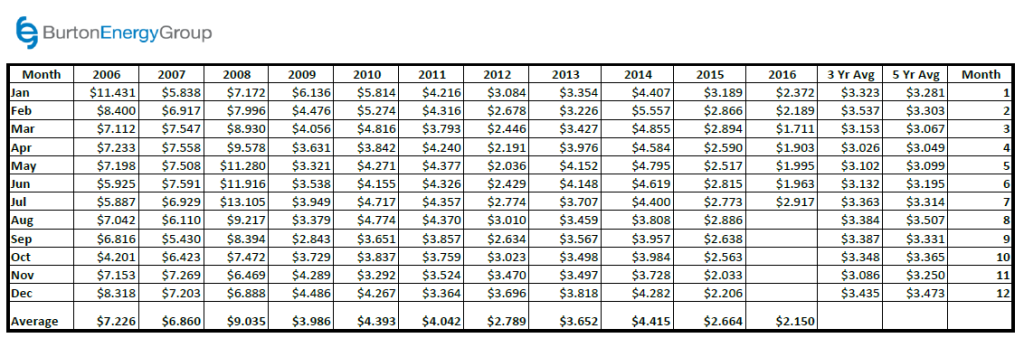

During 23 of the last 26 years of futures trading, natural gas has experienced a spring peak. 2016 appears to be following suit, as the July contract rolled off the board at $2.917 per MMBtu, the highest settlement this year. While Brexit has been impacting the financial markets and oil futures, it is the arrival of summer heat and the pull back in production that have led the charge to bring some price volatility back into the natural gas market. After production peaked during Q1 at 74 Bcf per day, it has sense declined to about 70.5 Bcf per day. In addition, as the market looked to settle, a plant explosion in Mississippi and a compressor station coming offline in West Virginia pushed prices higher into contract expiration. Storage injections for this time of year are well below the five-year average, however, stocks are still 22.8% higher than last year at this time and 25.4% above the five-year average. Power generators have enjoyed the low cost of natural gas to run their units, but with the increase in prices this past month, we will see if the generation mix changes and if it brings a few more rigs back online for producers.