Category Supply & Risk Management

Natural gas prices declined for seven straight weeks, but for the first time this year, closed out the other week slightly higher at $2.514 per MMBtu. Since then, the market has declined further, with the prompt month trading near $2.275… Continue Reading →

It has been a bearish start to the year for the natural gas market. Natural gas prices have fallen to their lowest level in more than a year, closing out last week with the February contract settling at $3.419 per… Continue Reading →

The natural gas fundamentals have continued to improve in recent weeks in the U.S. and market pricing has been reflective of this shift. Natural gas storage now sits 1% below last year’s level and 2.1% below the five-year average, for… Continue Reading →

Natural gas prices are up 73% year-to-date, but have recently fallen to a three-month low, after declining for the eighth straight week. The October NYMEX natural gas contract settled at $6.868 per MMBtu, nearly 27% below the September contract settle…. Continue Reading →

Natural gas prices experienced another month of wild swings. The August contract dropped below $6 per MMBtu, settling as low as $5.424 per MMBtu, to start the month. Significant heat and low storage injections sent prices rising more than 60%… Continue Reading →

After surging above $9 per MMBtu in May, natural gas prices have retreated significantly and the July contract settled at $6.551 per MMBtu, 26% below the June contract. The fire at the Freeport LNG facility has removed nearly 17% of… Continue Reading →

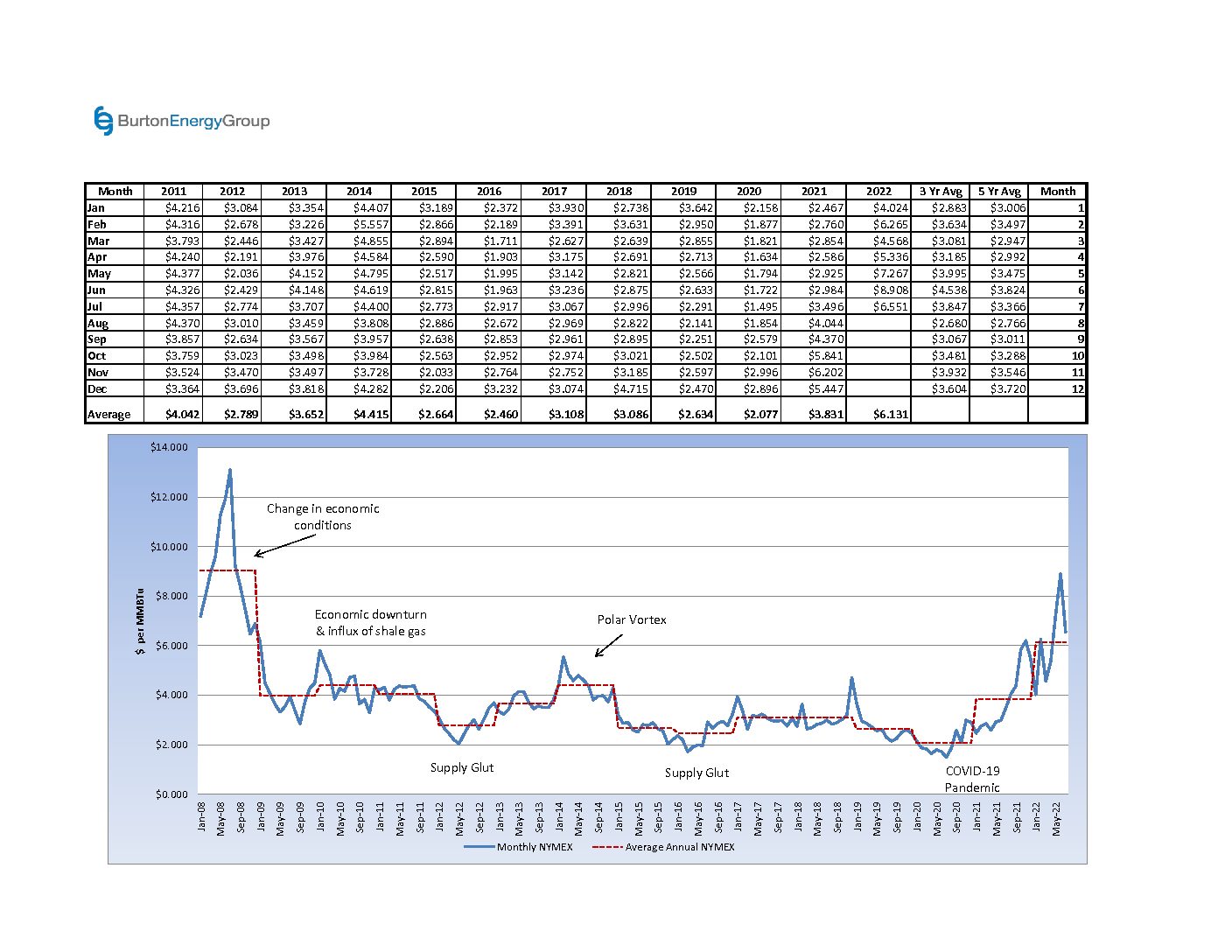

Financial players can assume some level of economic turbulence at the turn of every decade or so. As we closed out the 2021 calendar year and transitioned into 2022, American consumers and corporations were welcomed with the greatest inflationary levels… Continue Reading →

It has been a wild ride into spring this year, feeling more like a rollercoaster, with the volatility across the energy markets. The lingering winter temperatures, sanctions on Russia, increased exports, and market speculation has caused prices to whipsaw more… Continue Reading →

Natural gas prices experienced some relief last week, declining nearly 6% from the previous week’s close, but has recently disconnected from the rest of the energy market and is currently trending higher. The March contract rolled off the board at… Continue Reading →

“Volatility” and “unprecedented” continue to be the theme of energy markets as we move into 2022. Over the past year, natural gas contracts have experienced additional volatility on their final day of trading, before rolling off the board. On average,… Continue Reading →

Natural gas prices experienced a bit of a rally to close out the end of the year and the January 2022 NYMEX contract settled at $4.024 per MMBtu. For much of December, the current La Nina pattern in the Pacific… Continue Reading →

2021 is now in the books and natural gas prices averaged $3.831 per MMBtu for the year on NYMEX, 84% higher than the 2020 annual average. The bulls have lost some steam going into 2022 and natural gas prices have… Continue Reading →

The energy markets remain in a state of volatility, but U.S. production has increased month-over-month and LNG (liquified natural gas) exports appear to have reached their max. After six weeks of healthy storage injections, U. S. natural gas storage is… Continue Reading →

Natural gas prices have rallied to their highest levels since 2014. Last week, the October contract surpassed $5 per MMBtu, settling as high as $5.46 per MMBtu this week. The market fundamentals are facing bullish pressure domestically and globally, from… Continue Reading →

Natural gas prices are starting to see some relief, after settling below $4.00 per MMBtu for the first time in two weeks. The September contract continues to hover near the $3.90 per MMBtu level, after settling as high as $4.158,… Continue Reading →

Earlier this month, Enbridge Inc.’s Texas Eastern Transmission unit (TETCO) announced that its natural gas pipeline from Pennsylvania to Mississippi could be operating at reduced pressure until late third quarter, reducing flow to nearly 1 bcf per day, down from… Continue Reading →

Energy markets and deregulation have seen changes over the years, but one thing has not; the need for a strategy vs. just being a price taker in the market. I first began in the energy industry back in 2006 as working… Continue Reading →

Natural gas prices have been hovering near the $3 level these past two weeks, which continues to show some resistance. The May natural gas contract rolled off the board at $2.925 per MMBtu, 13% higher than the April natural gas… Continue Reading →

After polar vortex conditions overwhelmed Texas and the central U.S. during mid-February, electric and natural gas prices are returning to previous levels. While the daily market experienced the bulk of the volatility, forward electric and gas prices did feel the… Continue Reading →

The past few weeks have brought about quite a bit of uncertainty in the energy markets. President Biden has signed a number of Executive Orders, some of which were aimed at the energy industry, and colder than normal temperatures are… Continue Reading →

An electric supply rate is made up of multiple components. The cost of energy makes up the largest component, but the cost of capacity can be the second greatest cost component. In many deregulated markets, a capacity market exists, to… Continue Reading →