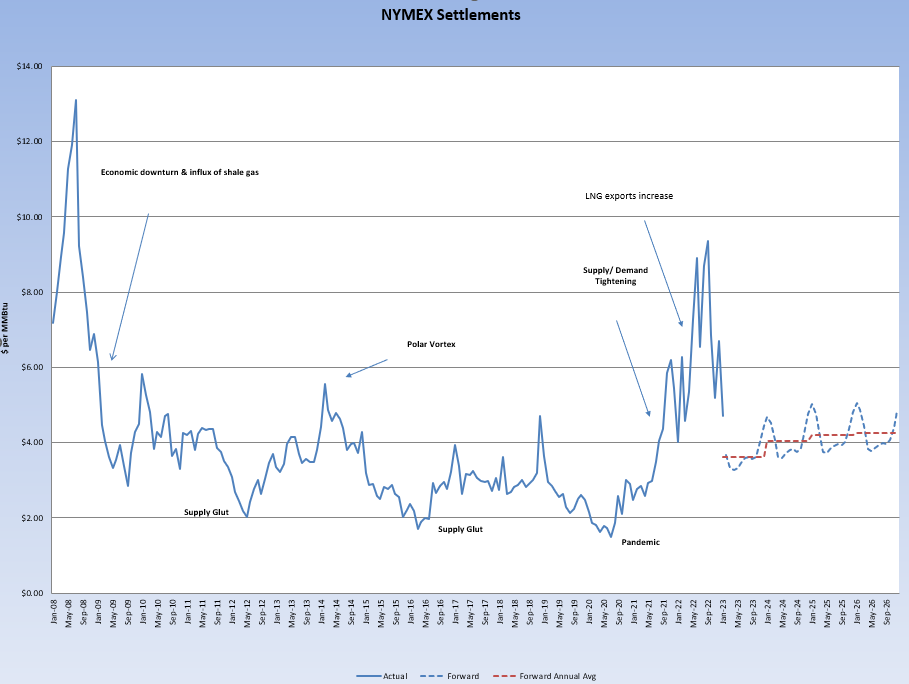

It has been a bearish start to the year for the natural gas market. Natural gas prices have fallen to their lowest level in more than a year, closing out last week with the February contract settling at $3.419 per MMBtu. After intense cold blanketed the U.S. in late December, the new year has started with above-average temperatures and the warming trend is expected to continue across much of the U.S. for the near-term. The U.S. Energy Information Administration (EIA) reported an injection of 11 Bcf last week, which has never been reported in January storage. Natural gas storage levels are now 4.6% below last year and 1.4% below the five-year average, for the same reporting week. For being only halfway through the winter season, this downward trend is somewhat unprecedented. The January contract settled at $4.709 per MMBtu, only 17% higher than the January 2021 settlement, and 52% below its peak of $9.862 per MMBtu on August 22nd. The February contract is currently trading 41% below last year’s settle and 60% below its peak close of $9.309 per MMBtu, also set in August 2022. Russia’s invasion of Ukraine last year spurred bullish pressure across natural gas markets. Throughout 2022, Europe was able to reduce gas demand through conservation efforts, fill storage facilities to capacity, shift power production to other sources (coal included), and a warmer-than-average winter has bolstered supply. European prices are now back to levels seen in early September of 2021. While the market is currently favorable and providing opportunities to hedge, the winter is not over and Europe will be looking to replenish its gas reserves again this summer, which a return in price volatility could spill over to the U.S. market.