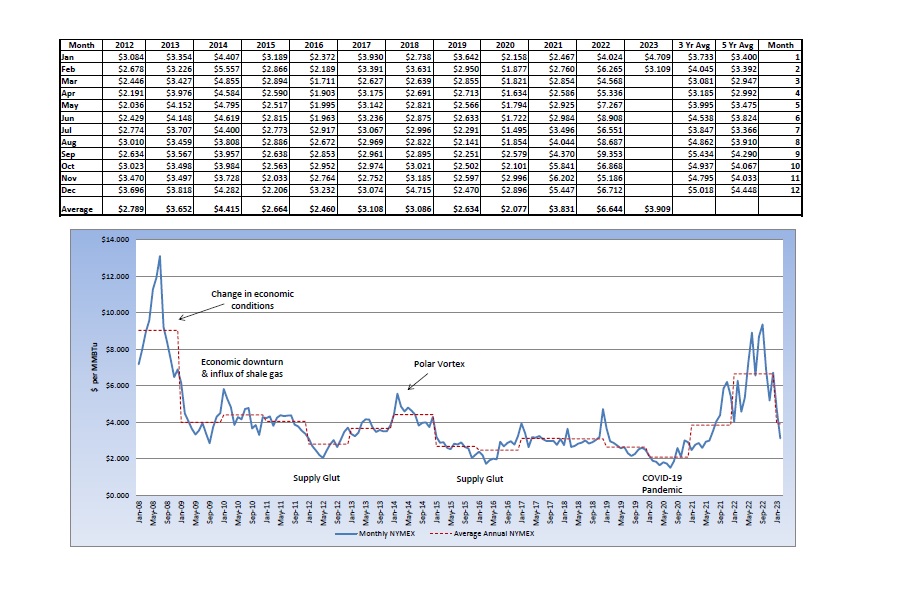

Natural gas prices declined for seven straight weeks, but for the first time this year, closed out the other week slightly higher at $2.514 per MMBtu. Since then, the market has declined further, with the prompt month trading near $2.275 per MMBtu, which is still 50% below the March 2022 settle. Natural gas inventories continue to grow compared to previous years. On Thursday, The U.S. Energy Information Administration (EIA) reported a withdrawal of 100 Bcf last week, after temperatures started to turn more mild. Natural gas storage levels are now 16.9% above last year and 8.8% above the five-year average, for the same reporting week. For much of the U.S., temperatures are forecast to be normal or above-normal for the next couple of weeks. This limits demand for heating and continues to place bearish pressure on natural gas prices. In the event extreme temperatures do arrive, it’s expected that it would have a limited impact on natural gas prices moving higher, since we are currently trading the March contract. The February contract settled at $3.109 per MMBtu, 50% below the February 2022 settle. While most of the U.S. is appreciating this significant decline in natural gas prices, the Northeast did experience some volatile daily pricing earlier this month, where natural gas prices reached $26 per MMBtu. California; however, has seen natural gas prices spiking even higher than last year. Natural gas storage levels are below average in the West and supply constraints have been a large price driver this year, but consumer advocates have other concerns. Governor Newsom recently sent a litter to the Federal Energy Regulatory Commission (FERC) requesting an investigation into potential market manipulation, anticompetitive behavior, or other anomalous activities, that could have driven prices higher. In response, the California Public Utilities Commission (CPUC) voted to accelerate the California Climate Credit, so customers could start seeing credits on their invoices as early as next month.