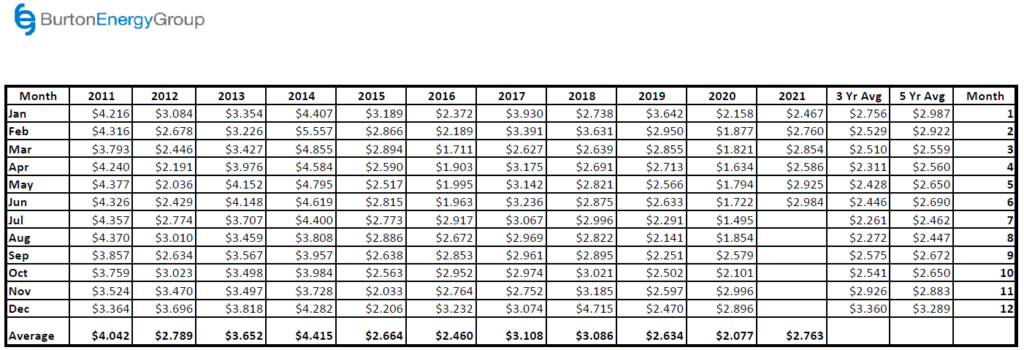

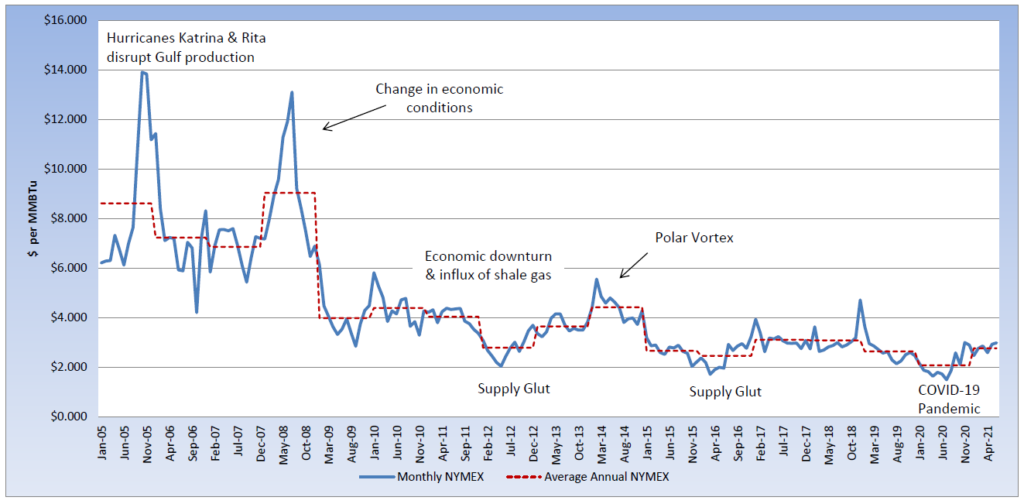

Earlier this month, Enbridge Inc.’s Texas Eastern Transmission unit (TETCO) announced that its natural gas pipeline from Pennsylvania to Mississippi could be operating at reduced pressure until late third quarter, reducing flow to nearly 1 bcf per day, down from 1.9 bcf per day in May. This news came along with increasing temperatures for the 5-day forecast with increased cooling demand expected, especially in the West and Texas. Traders have been focused on the logistical concerns to meet increasing demand and prices have reached their highest level in more than 7 months. The July natural gas contract appears to be meeting resistance at the $3.40/MMBtu level, as price volatility returns to the market. The June contract settled at $2.984 per MMBtu and natural gas prices through 2021 have averaged more than 50% higher, compared to the first six months of 2020. While 2020 was an anomaly (we hope), all commodities are seeing price increases and as the dollar loses value, speculative traders will look for other commodities that they believe have a potential for more upside and the market could experience additional price movement, aside from market fundamentals. Last week, the U.S. Energy Information Administration (EIA) reported a natural gas storage injection of 16 Bcf, after a reclassification of gas stocks in the Pacific region. At current levels, natural gas storage sits 15.7% below last year and 4.9% below the five-year average, for the same reporting week. Natural gas production continues to rise, which could help offset a more bullish run in natural gas prices. EIA is now projecting natural gas prices to average $2.92 per MMBtu in Q3 and $3.07 per MMBtu in Q4, as growth in liquefied natural gas (LNG) exports occurs and domestic consumption increases, outside of the power sector.