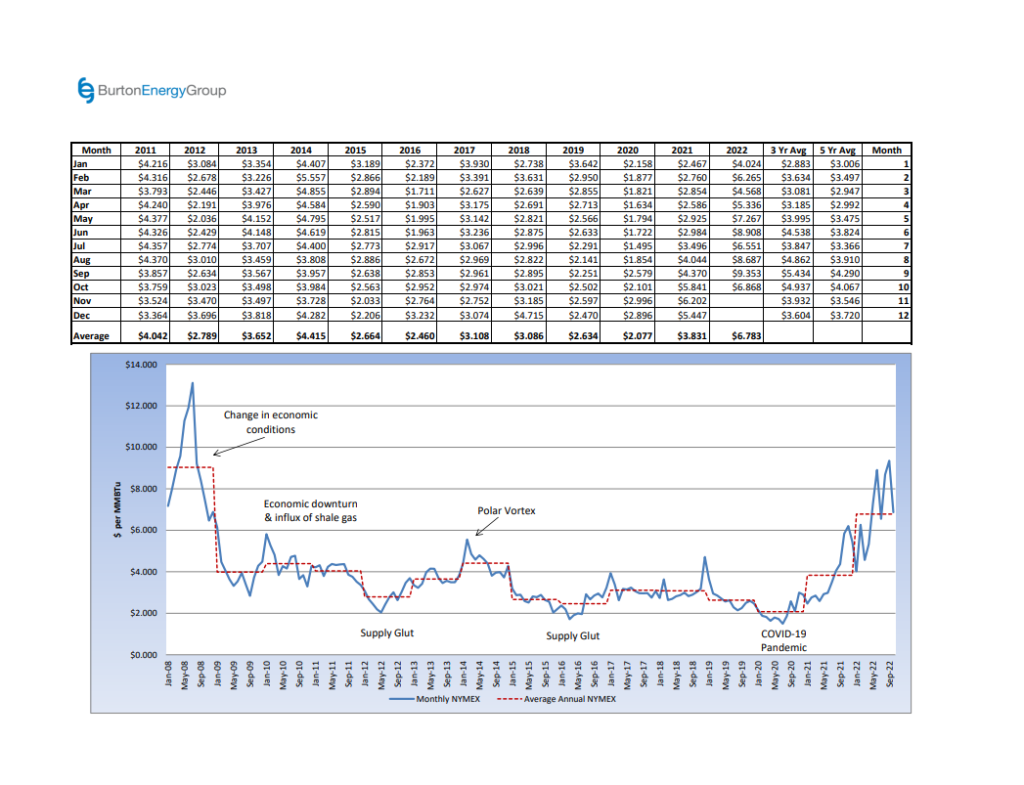

Natural gas prices are up 73% year-to-date, but have recently fallen to a three-month low, after declining for the eighth straight week. The October NYMEX natural gas contract settled at $6.868 per MMBtu, nearly 27% below the September contract settle. On Friday, the November contract closed out the week at $6.453 per MMBtu. Natural gas production continues to rise. September set a monthly record of 99.4 Bcf/day, only to be surpassed by production levels in October, reaching 99.9 Bcf/day. Strong production and milder temperatures have led to healthy storage injections. The U.S. Energy Information Administration (EIA) reported last week an injection of 125 Bcf, the fourth week in a row of a triple digit injection. This now raises the U. S. storage level to 3,231 Bcf, which is only 3.8% below last year and 6.4% below the five-year average. European natural gas storage levels have also continued to grow, including Germany, which is about 95% full, reducing the risk of facing shortages or rationing this winter. This has also placed bearish pressure on natural gas prices in Europe, driving prices down to about $40 per MMBtu, after averaging as high as $90 per MMBtu in August. Cooler temperatures are spreading across the Midwest and into the East and dropping below normal for a few days, where heating demand is expected to rise. Cooling demand should also come to an end in the South, Texas, and the West, as more mild temperatures move in this week. The Freeport LNG facility is also expected to restart partial production in November, to begin exporting LNG again. Fundamentals have continued to improve in the U.S., but winter temperatures and heating demand this winter could draw down storage levels.