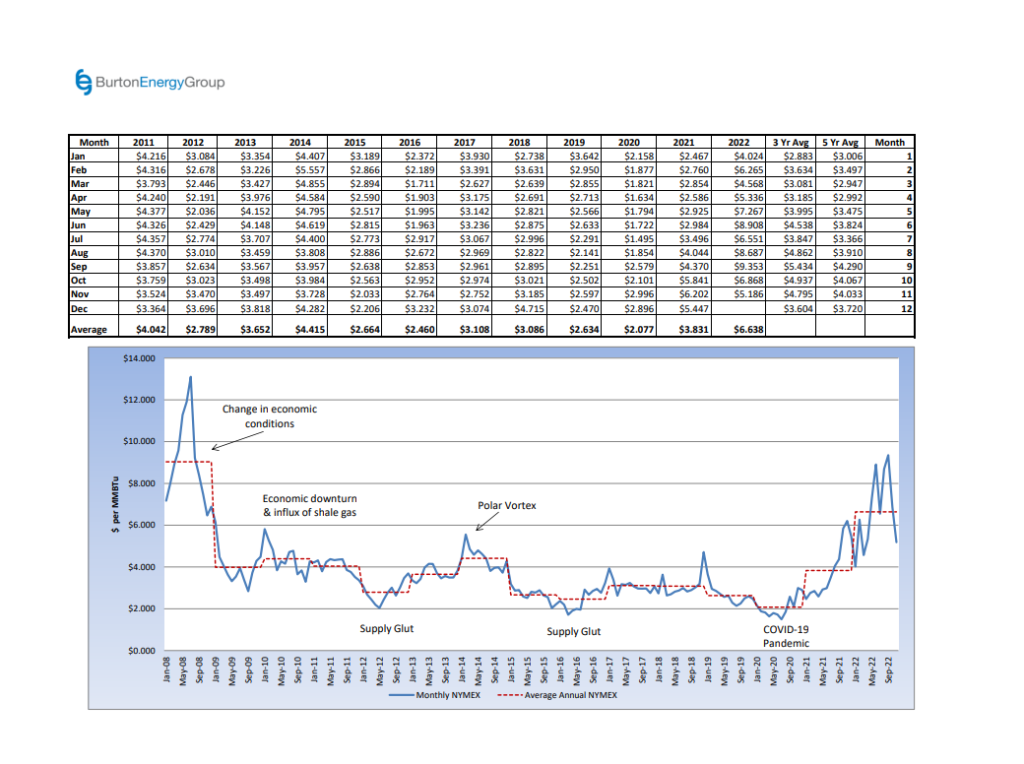

The natural gas fundamentals have continued to improve in recent weeks in the U.S. and market pricing has been reflective of this shift. Natural gas storage now sits 1% below last year’s level and 2.1% below the five-year average, for the same reporting week. The U.S. Energy Information Administration (EIA) reported an injection of 79 Bcf last week, after reporting triple-digit injections for five consecutive weeks. Injection season typically comes to an end at the end of October; however, the market is anticipating another injection of near 60 Bcf this week, which compares to last year’s injection of 23 Bcf and the five-year average of a 5 Bcf withdrawal. Another healthy injection this week could close the gap in storage levels from last year. The November natural gas contract settled at $5.186 per MMBtu, 16% below the November 2021 settlement. The December contract has moved into the prompt position and kicked off this week at $5.503 per MMBtu, near the same level where December 2021 settled. Production levels have exceeded EIA’s expectations for 2022 and along with mild temperatures, the outage at the Freeport LNG facility has helped to better position the U.S. to meet the upcoming winter demand. This improved picture of natural gas supply has helped bring prices down from the $9-$10 per MMBtu levels we were experiencing this summer. The EIA now forecasts that natural gas prices will average near $6 per MMBtu across Q4 2022 and Q1 2023, which is more than $1 per MMBtu less that their projection in October. The market will focus on this winter’s temperatures and its impact on demand. The EIA is forecasting a colder winter, which would drive larger storage withdrawals and position our storage levels below the five-year average.