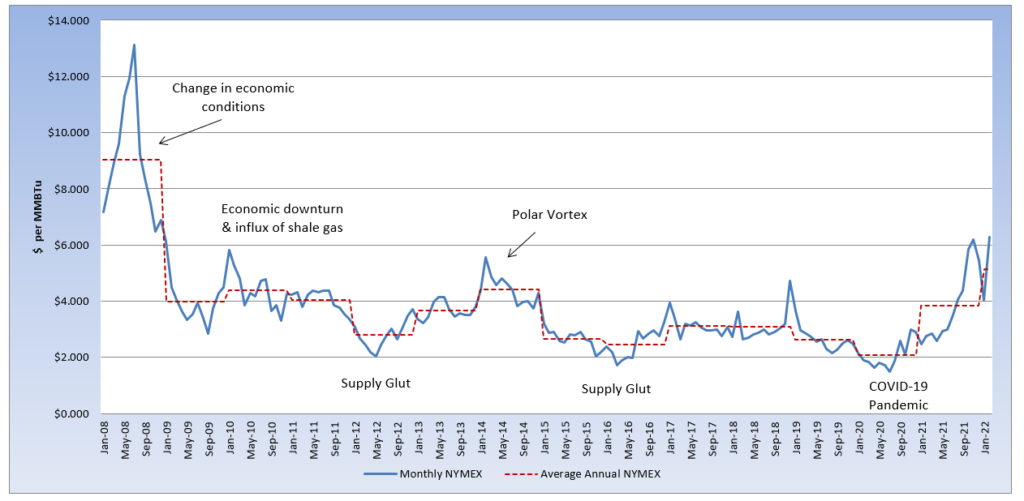

Natural gas prices experienced some relief last week, declining nearly 6% from the previous week’s close, but has recently disconnected from the rest of the energy market and is currently trending higher. The March contract rolled off the board at $4.568 per MMBtu and the April contract has settled as low as $4.402, but recently settled at $5.147 per MMBtu, since moving into the prompt position. The market was expecting a bearish weather pattern with warmer temperatures, but a recent forecast change is showing cooler than expected temperatures in the near term. Strong production levels should start to benefit natural gas storage levels with shrinking withdrawals and injections expected in the next couple of weeks. The Energy Information Administration reported a withdrawal of 79 Bcf for the week ending March 11th, putting storage levels 19% below last year and 17% below the five-year average, for the same reporting week. Market expectations are that end-of-season storage levels will come in above 1.4 tcf. The invasion of Ukraine by Russia has been the driving bullish factor of natural gas. Russian gas flows and LNG supply into Europe have been stable; however, the market is extremely cautious as the risk of Russia cutting off gas supply remains, especially with the U.S banning Russian energy imports and other countries potentially following. Additionally, the European Commission has laid out a plan to wean itself from Russian gas, with alternative supplies mostly coming from LNG imports, which will keep demand high for U.S. exports. The uncertainty and bullish pressure on European gas prices continue to drive natural gas and electric prices in the U.S. Index prices across most electric markets have declined in recent weeks, but forward wholesale pricing for most calendar strips are trading near their highest levels.