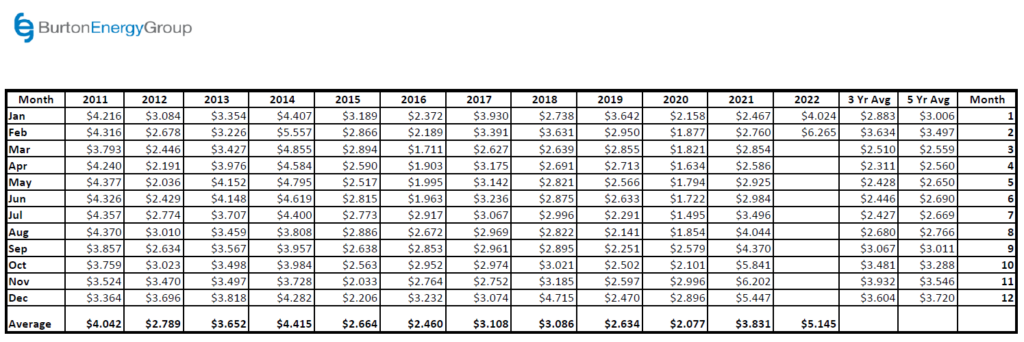

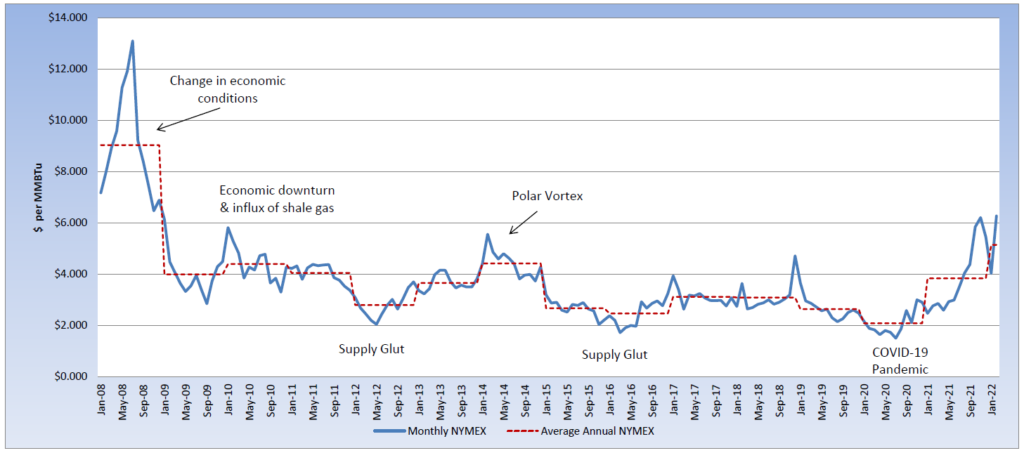

“Volatility” and “unprecedented” continue to be the theme of energy markets as we move into 2022. Over the past year, natural gas contracts have experienced additional volatility on their final day of trading, before rolling off the board. On average, the increase has been about $0.12, but the February contract set a new record. During the last half-hour of trading, the February contract skyrocketed more than 70% to $7.35/Dth, before finally settling at $6.265/Dth, a 46% increase on the day. It was the greatest one-day increase for natural gas since it began trading on NYMEX in April 1990. This type of movement is suggestive of a large player getting caught short. The market had already been facing bullish pressure that day, with the weather forecast projecting even colder temperatures than expected for the first two weeks of February. As colder temperatures stretched deep into Texas, the market turned its attention to ERCOT and its ability to maintain grid reliability for its first winter-weather test. ERCOT and Governor Abbott continued to reinforce that the steps they took to winterize the grid this past year would provide stability and they maintained a 20% reserve margin for peak demand. The day-ahead market saw some price spikes, but real-time prices experienced minimal volatility. The March natural gas contract moved into the prompt position at $4.64 per MMBtu, reaching $5.50 per MMBtu within a couple of days of trading. Since then, the market has been responding to slightly warmer temperatures and a decline in natural gas prices in the European market. After multiple days of solid declines, the March contract is currently trading just below $4.00 per MMBtu. After this week’s reported withdrawal of 222 Bcf by the Energy Information Administration (EIA), natural gas storage sits 17.3% below last year’s level and 9.3% below the five-year average, for the same reporting week. As we hope that Punxsutawney Phil is incorrect with his prediction of six more weeks of winter, the market will continue to focus on where storage sits at the end of winter, the production outlook to refill storage levels this summer, and continued demand from Europe and power generators.