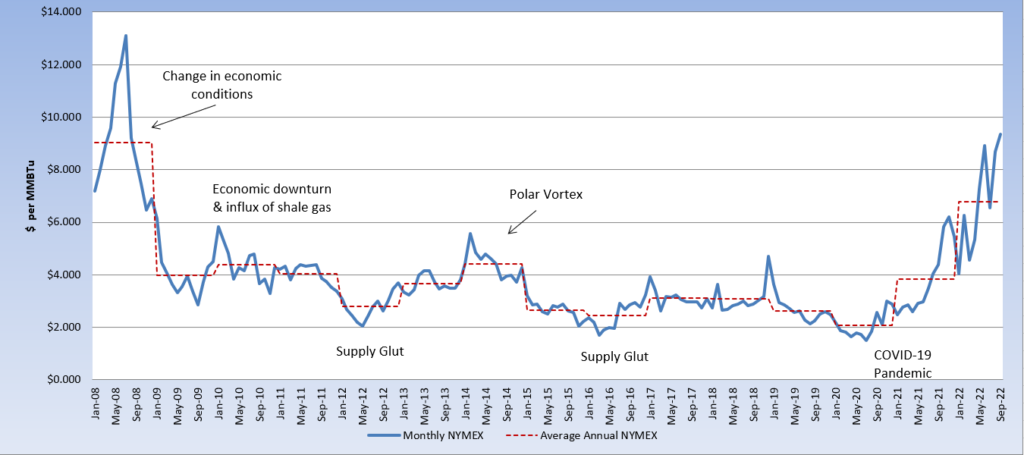

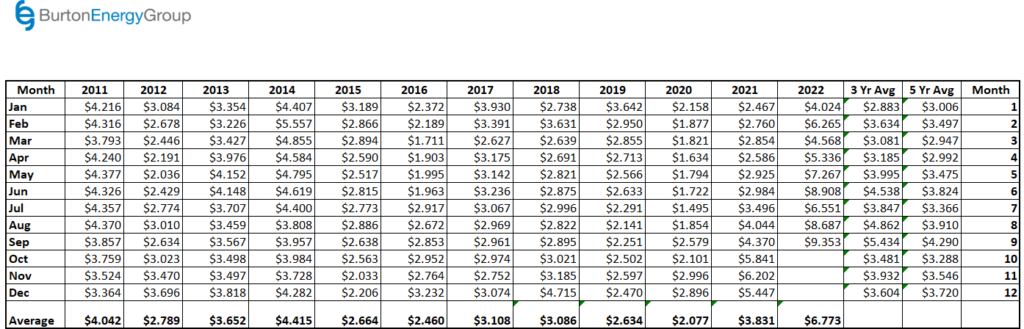

Natural gas prices experienced another month of wild swings. The August contract dropped below $6 per MMBtu, settling as low as $5.424 per MMBtu, to start the month. Significant heat and low storage injections sent prices rising more than 60% and the August contract settled at $8.687 per MMBtu. The September contract moved into the prompt position and opened with a decline to $8.134 per MMBtu. Overall, the September contract has traded in a tighter range and settled the week at $8.064 per MMBtu. Natural gas storage injections have been below average in recent weeks, with some parts of the country withdrawing from storage, in order to meet cooling demand and balance plant outages. On Thursday, the U.S. Energy Information Administration (EIA) reported a natural gas storage injection of 41 Bcf, exceeding market expectations. Natural gas storage levels are now 9.8% below last year and 12.1% below the five-year average, for the same reporting week. The market is finding resistance at the $9 per MMBtu level, but is struggling to break through support and trade below $8 per MMBtu, through this winter. Increased supply and a pull back in demand should continue to build storage levels in the U.S. and put the market in a better position this fall and headed into winter. Pipeline capacity; however, has not been built to keep up with the increased demand and multiple markets are experiencing significant constraints and high basis prices, especially for the summer. Enterprise Products Partners recently reported that natural gas pipeline volumes reached a record level in the second quarter of 2022 and that they were adding three pipeline expansions in the Permian Basis, to support production growth. Senator Joe Manchin also worked to include completion of the Mountain Valley Pipeline in the government funding bill, which the Senate passed over the weekend. The pipeline infrastructure and power grid will continue to need additional investments to meet growing demand.