Financial players can assume some level of economic turbulence at the turn of every decade or so. As we closed out the 2021 calendar year and transitioned into 2022, American consumers and corporations were welcomed with the greatest inflationary levels since the banking crisis of the 1980’s, causing reactions of dire concern. History tells us that it usually will take a 2–3-year period to reach normalcy. Since then, markets have always returned to equilibrium due to fundamental basics. YTD inflation has risen to an astounding 8.27%, due in part to an emerging supply/demand, and broken supply chains, leaving many products not making it to market.

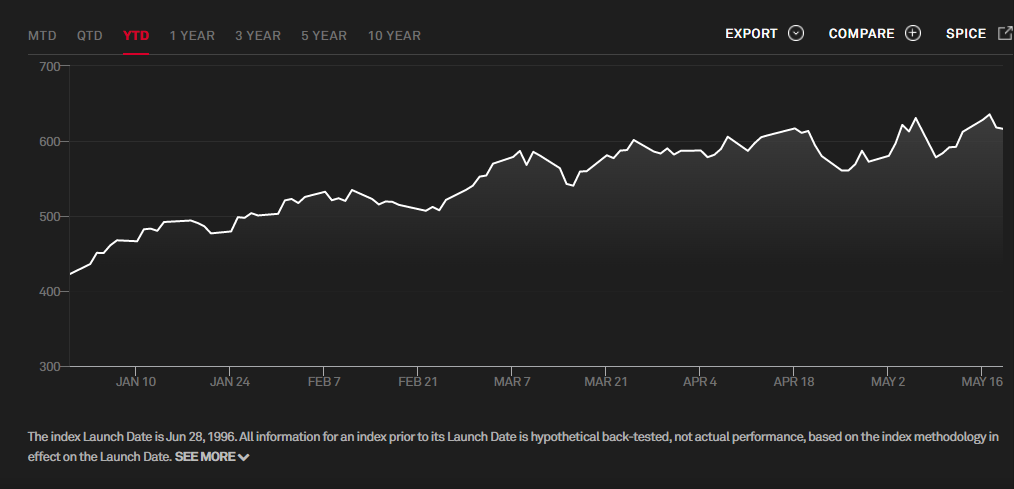

Having a portfolio that is safeguarded by inflation is of importance, and many investors will acquire Treasury Inflation-Protected Securities (TIPS) to combat risk. However, TIPS can be pricey and do not garner the returns that other investment options provide. Holding long positions in asset classes such as the Energy sector looks to be a safe bet when hedging against inflation, as they offer higher than average yields. YTD, the Energy Sector Index has generated the highest returns (44.38%) of all 11 equity sectors that form the S&P500. (Yahoo Finance). Over 14% more than the next best index. Why so? Historically the price of oil and gas has risen more than the associated costs of extracting it and pushing it to market. The period we are enduring now is truly like no other. Months into the Financial Crisis of 2008-2009, oil prices dropped over 300% due to a decline in demand brought forth by a contraction of credit with which to make purchases (Investopedia). Fast forward 14 years, to the advantage of Upstream, Midstream, and Downstream corporations, the end of the COVID-19 pandemic has demand flourishing. As most people have returned to work, and enjoyed the luxuries of travel, transportation levels have skyrocketed, and some of the biggest energy companies have responded by investing in large upstream projects pushing cash flows to favorable positive amounts. For the energy industry, be on the lookout for “juicy” Q2 dividend yields, reaching range of 6 – upwards of 8%, and rising EPS estimates. Top banks such as Bank of America have invested heavily in S&P 500’s top performing stock YTD, exploration company Devon Energy (DVN). The oil giant posted revenues increasing 18% YTD and holds a healthy YTD ROIC of 20.47%. This signals that the company produces greater ROI than it costs them to raise the capital needed for that project. (Guru focus). For both big financial institutions and the savvy investor, arbitrage opportunities are accessible. In the world we live in today, some security and a bright outlook is needed. In an industry that is primed for lucrative projects over the next few years, I think energy is a strong and comparatively safe bet for investors, when placed against other sectors.

At Burton, we do not consider ourselves to be financial players nor financial advisors. However, by keeping up with market trends, forecasts, and regulatory actions, we can relay valuable information to our customers who are buying gas and electricity from a wide array of these energy suppliers that trade on the open market.