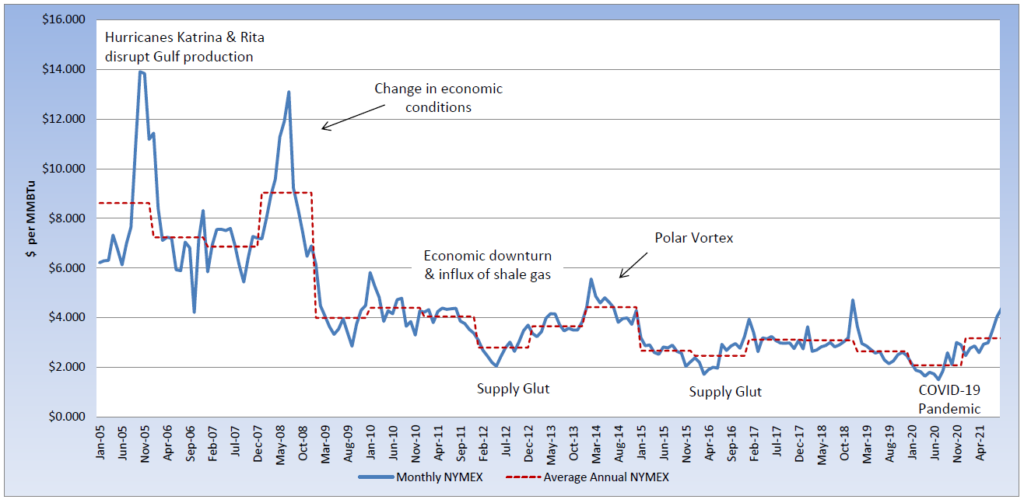

Natural gas prices have rallied to their highest levels since 2014. Last week, the October contract surpassed $5 per MMBtu, settling as high as $5.46 per MMBtu this week. The market fundamentals are facing bullish pressure domestically and globally, from the lingering summer heat in certain parts of the country, a potentially early start to winter, below-average storage levels, and robust LNG (liquified natural gas) and pipeline exports. This lingering heat has continued to increase demand for cooling, while traders are also looking at this winter’s forecast, and how the potential for below-average temperatures will impact natural gas demand for heating. This week’s robust storage report of 83 Bcf appears to have paused the market’s bullish run, but the concern remains with natural gas storage being 7.1% below the five-year average and nearly 16.5% below last year’s storage level, for the same reporting week. Shut-in production in the Gulf and along the coast of Louisiana has hampered production levels, since Hurricane Ida took more than 90% of production offline in that region. Natural gas remains plentiful, but after multiple years of low-cost natural gas, producers are cautiously investing capital in these robust shale plays. Natural gas prices are feeling the pressure of a tighter supply and demand balance here in the U.S. and production is unable to keep up with the growing global demand and increasing LNG exports to Asia and Europe, as well as pipeline shipments to Mexico. U.S. consumers have been seeing the impact of rising oil prices at the pump, but rising prices across the energy sector will have a widespread impact on consumer goods and utility costs. While the market appears poised for a price correction, additional bullish news could quickly drive prices higher, affecting more than just heating costs this winter.