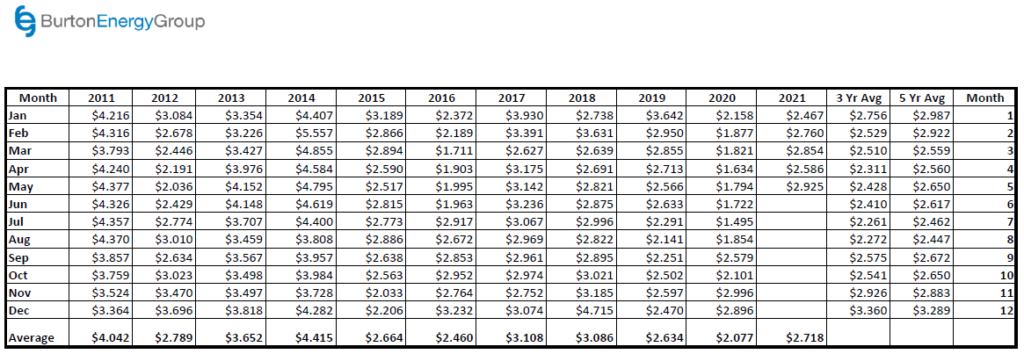

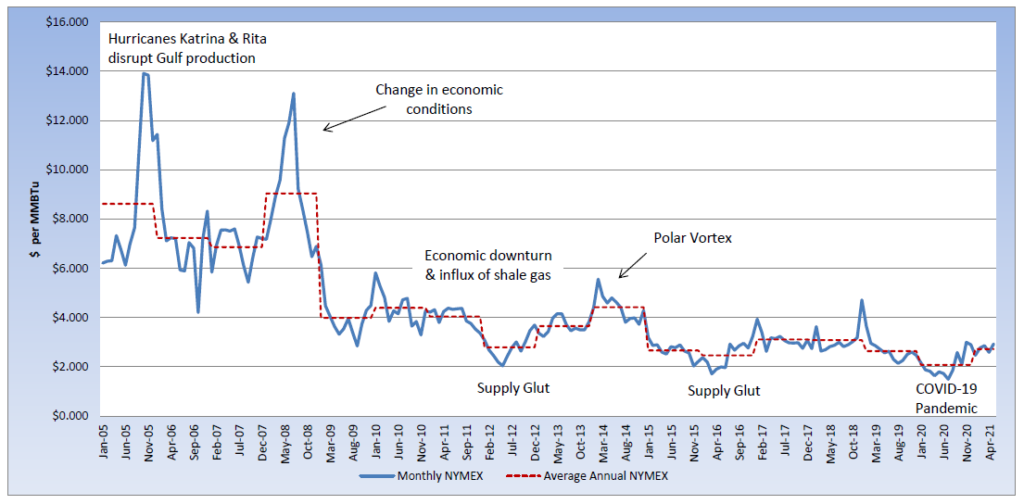

Natural gas prices have been hovering near the $3 level these past two weeks, which continues to show some resistance. The May natural gas contract rolled off the board at $2.925 per MMBtu, 13% higher than the April natural gas contract. The average NYMEX settlement for 2021 is $2.718 per MMBtu, about 46% above the 2020 average. A recovering economy and increased demand for natural gas this winter has fueled the significant year-over-year increase. The June contract moved into the prompt position nearly flat to the May settlement and has bounced around in a tight range these last ten days of trading. From a fundamental perspective, natural gas prices have little reason to be trading this high. While spring has started off cooler than average, warmer temperatures continue to remain on the horizon and demand for natural gas will decrease. Additionally, scheduled production maintenance has occurred, and levels are turning higher. Natural gas storage levels remain within the five-year average range. According to the U.S. Energy Information Administration (EIA), an injection of 71 Bcf occurred the week ending May 7th. This puts working gas in storage at 2,029 Bcf, which is 3% below the five-year average and nearly 16% below last year, for the same reporting week. Expectations are that production will continue to recover in 2021 and while we may continue to experience a small deficit in storage, the difference will close, as production levels look to return to more than 90 Bcf per day. Increased production levels should also place some bearish pressure on near-term gas prices.