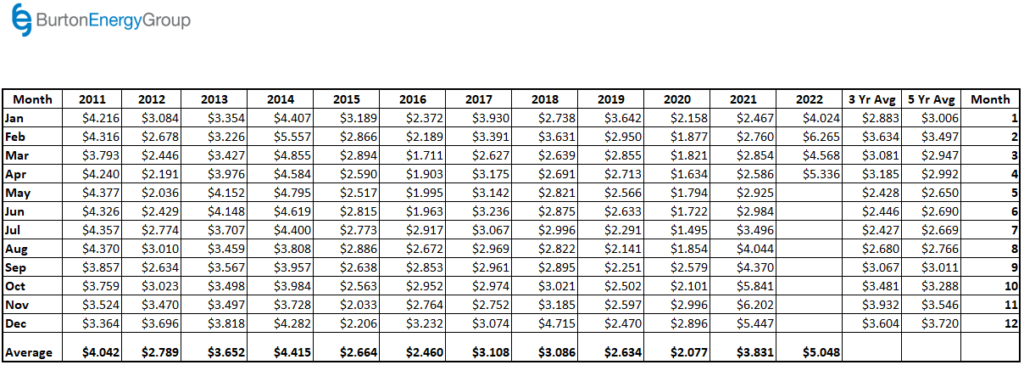

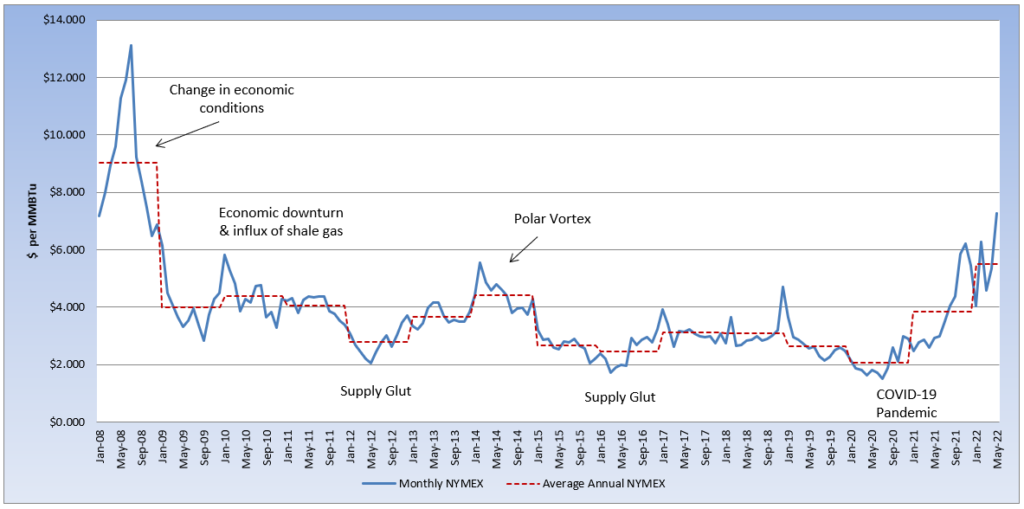

It has been a wild ride into spring this year, feeling more like a rollercoaster, with the volatility across the energy markets. The lingering winter temperatures, sanctions on Russia, increased exports, and market speculation has caused prices to whipsaw more than a dollar per MMBtu in less than a week. The April NYMEX contract settled at $5.336 per MMBtu, 13% above the March contract. The May contract moved into the prompt position and immediately accelerated higher, reaching above $8 per MMBtu last week, before quickly retreating. The May contract is lingering near the $7 per MMBtu level. Last week, the U.S. Energy Information Administration released a bearish storage report of an injection of 53 Bcf. Natural gas storage levels remain nearly 23% below last year’s level and about 17% below the five-year average, for the same reporting week. The market; however, was anticipating a smaller build of about 36 Bcf, placing some bearish pressure on pricing. As we continue to move into spring and warmer temperatures take over, the natural gas storage builds should continue. The U.S. continues to also maximize its liquified natural gas (LNG) exports in favor of higher prices in Europe. Additionally, the lack of investment in pipeline infrastructure is also increasing the cost to transport natural gas and in some areas of the country, this cost can exceed the cost of the commodity. Even as the market fundamentals start to improve, the underlying uncertainty around production investments and available supply this upcoming winter will continue to place bullish pressure on pricing.