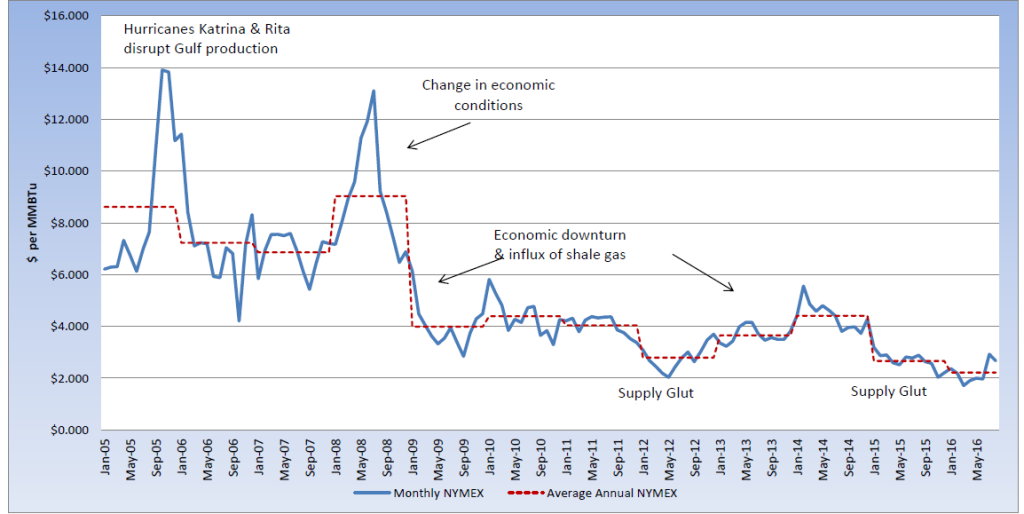

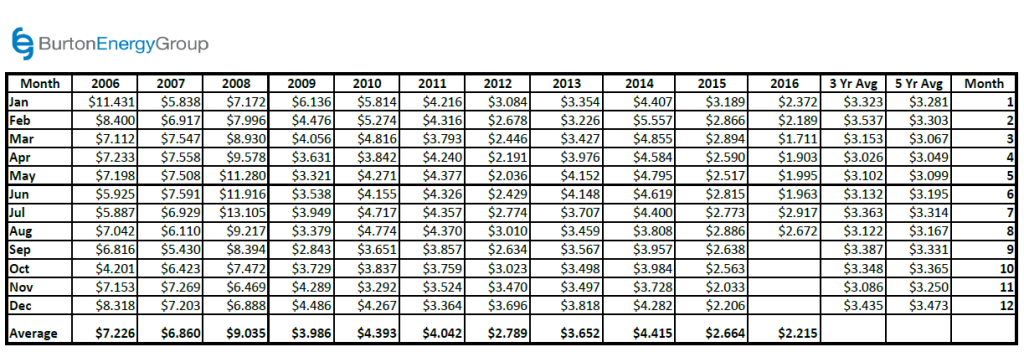

Natural gas continues to be range-bound, while traders alternate their focus between summer coming to an end and ample supply in storage, verses increased demand for power generation and below average storage injections. The August contract settled at $2.672 per MMBtu, 8% below the July contract settlement. As the September contract has moved into the prompt position, it has traded as low as $2.651 per MMBtu, but rebounded as high as $2.911 per MMBtu. For the first time in ten years, the market experienced a summer withdrawal from storage last week. After a brief spike after the report was published, natural gas prices calmed down and settled down just slightly for the day. Even with the withdrawal, natural gas storage is 16.4% above the five-year average and 13.4% above last year, for this same reporting week. Increased demand, exports and weak storage injections continue to prevent the bears from pushing through key support levels, but as we approach the end of the summer and injection season, natural gas storage levels will be a significant driver to how natural gas trades during the next few months.