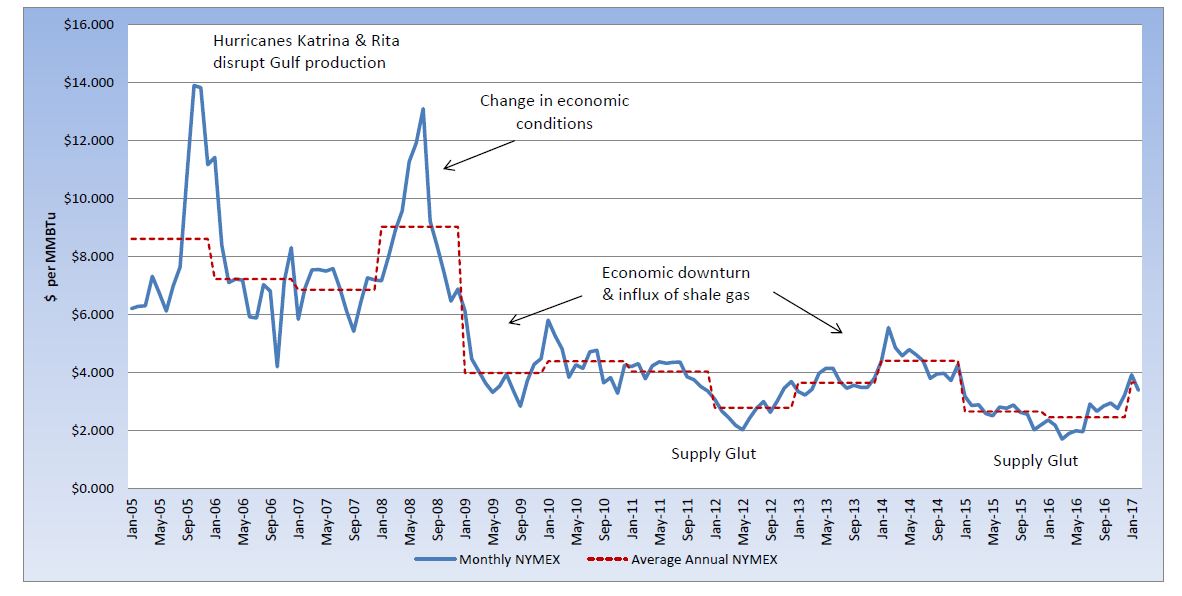

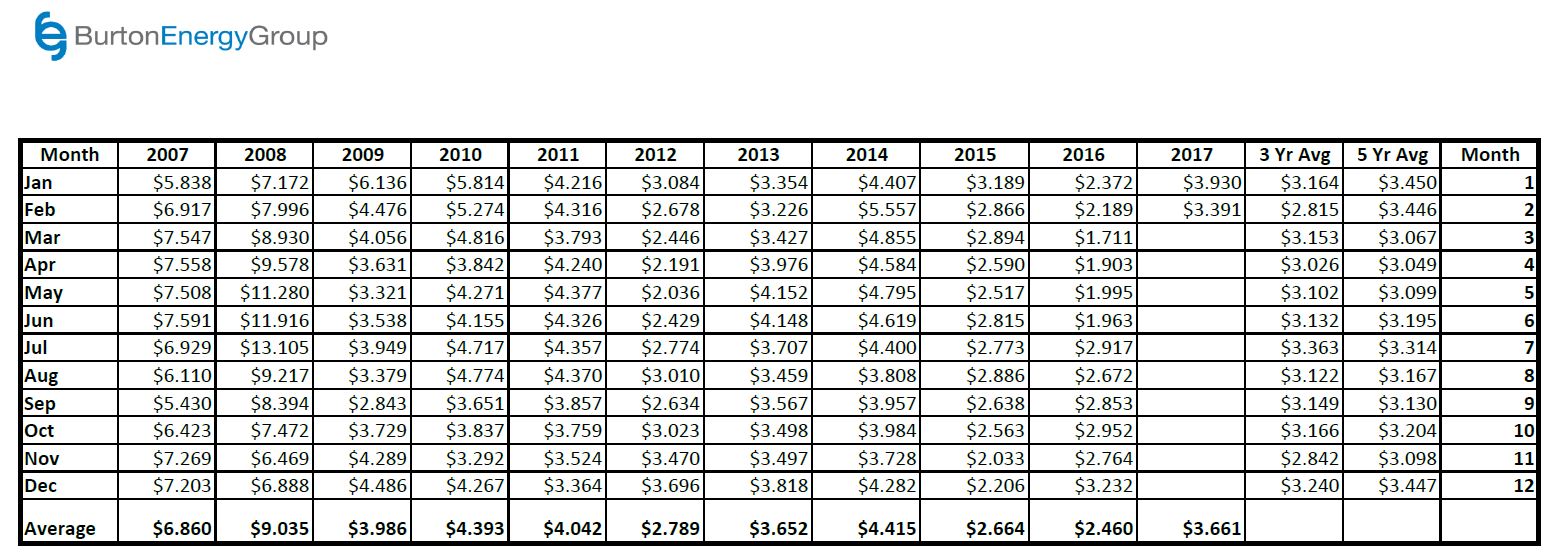

The bulls and bears are having a turf war over the natural gas market. The February contract rolled off the board on Friday at $3.391 per MMBtu, nearly 14% below the January contract, after experiencing a large swing throughout the month. The debut of the February contract in the prompt position saw a quick run to as high as $3.884 per MMBtu, but as arctic weather moved out and more mild temperatures blanketed the United States, the contract declined as low as $3.098 per MMBtu. With about half of the homes in the U.S. burning natural gas for heating purposes, this market reacts swiftly to changes in underground storage and updated weather forecasts. Last week, natural gas storage declined by 119 Bcf, but a milder drawdown of about 70 Bcf is expected from this week’s report by the EIA. As weather forecasts become more uncertain and conflicting about the return of cold weather, traders are quickly switching positions. Additionally, the decline in production due to spending cuts in the drilling industry are causing pause to a potentially bearish sentiment in this market. The March contract moved into the prompt position and has experienced about a 3% decline from its previous settle.