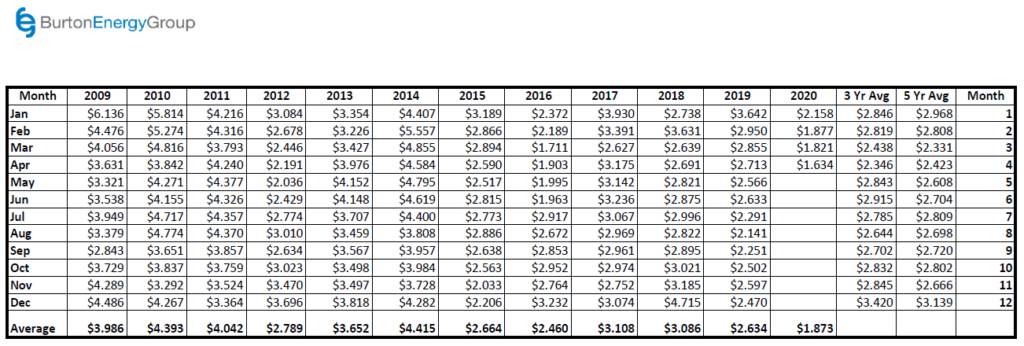

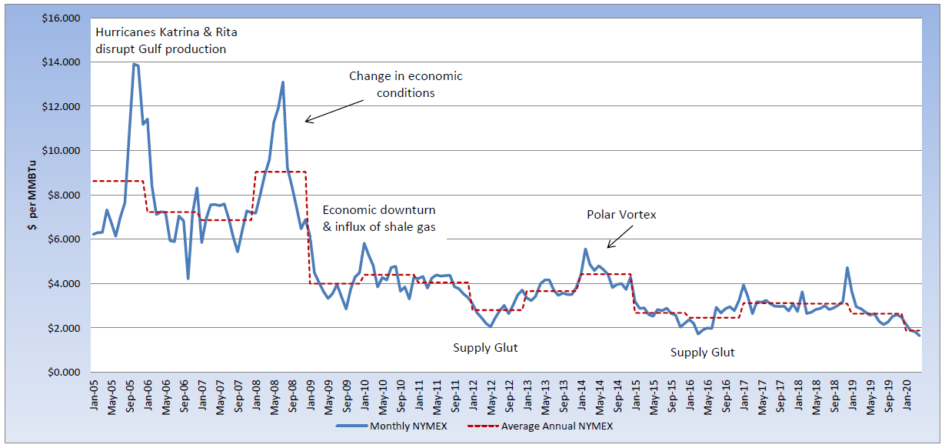

Economic uncertainty has been weighing on all markets, as the effects of COVID-19 have been shuttering businesses and overturning industries, resulting in employee furloughs and lay-offs. The energy commodity markets have been focused upon the oil market and its ability to rebound off recent lows. After four days of meetings, OPEC and its allies have agreed to cut production by 9.7 million barrels per day, the single largest output cut in history. After the announcement was made, prices remained relatively unchanged, while producers and investors still focus on the 30% drop in demand. Oil prices may have reached their floor, but the amount of inventory is weighing on the market’s ability to boost prices. Natural gas prices have experienced a slight rally in the near-term, as the news of oil production cuts and shut-in wells will lead to less associated gas coming to market. Associated gas is natural gas produced by oil wells. In addition, cooler temperatures are expected across the eastern part of the U.S. in the 6 – 10 day outlook. The April contract settled at $1.634 per MMBtu, 10% lower than the March contract settle. Natural gas prices for CY2020 are currently averaging at $1.873 per MMBtu, which is 38% below where the 2019 natural gas prices were averaging through April. The May contract moved into the prompt position at $1.67 per MMBtu and after settling as high as $1.85 per MMBtu, is currently trading near $1.68 per MMBtu. Despite bullish factors around weather and the expected decline in associated gas, the natural gas market is weak, as demand destruction, surplus gas, and the delay in decreased production weighs heavily on the market.