Category Supply & Risk Management

The Summer Solstice occurs around June 20th or 21st (depending upon your time zone) and technically marks the first official day of summer. For many of us, however, we gauge the start of summer by the weather! This year, traders… Continue Reading →

We are officially in the shoulder season and the natural gas market is falling back into old habits. It is not uncommon for the natural gas market to increase in the second quarter. In fact, over the past twenty-six years,… Continue Reading →

The natural gas market appears to have shifted somewhat from a bearish sentiment due to warmer temperatures in February, to a more bullish sentiment as the supply/demand balance becomes more of a focus for the near-term. The April contract rolled… Continue Reading →

March Madness is just around the corner and the natural gas bears appear to be shutting down any Hail Mary shots the bulls are taking to push this market higher. To close out the “typical” winter season term, the March… Continue Reading →

The bulls and bears are having a turf war over the natural gas market. The February contract rolled off the board on Friday at $3.391 per MMBtu, nearly 14% below the January contract, after experiencing a large swing throughout the… Continue Reading →

Times Square wasn’t the only place setting off fireworks to ring in the new year. The natural gas market kicked off 2017 with quite a bang! After news of an arctic blast and a storage withdrawal of 237 Bcf, the… Continue Reading →

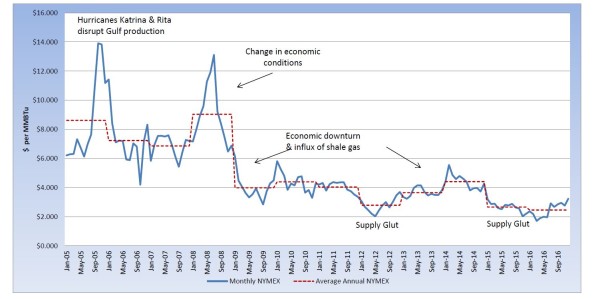

Natural gas for the CY2016 strip has now officially settled. After the bears drove the December contract down to $2.546 per MMBtu with an above-average November and record high storage levels, the bulls managed to gain momentum heading into Thanksgiving… Continue Reading →

It looked as though the Chicago Bears and natural gas bears were abandoning us this fall, neither of which looking like they would be part of the conversation this season. While the Chicago Bears continue to sort out their quarterback… Continue Reading →

After moving into the prompt position, the October contract quickly dipped to $2.827 per MMBtu and eventually slid to $2.676 per MMBtu. Since hitting that key support level, the bulls continued to try to push the October contract above $3… Continue Reading →

Natural gas continues to be range-bound, while traders alternate their focus between summer coming to an end and ample supply in storage, verses increased demand for power generation and below average storage injections. The August contract settled at $2.672 per… Continue Reading →

During 23 of the last 26 years of futures trading, natural gas has experienced a spring peak. 2016 appears to be following suit, as the July contract rolled off the board at $2.917 per MMBtu, the highest settlement this year. … Continue Reading →

After a bit of a wild ride, the June contract pulled back yesterday to a one month low and settled at $1.963 per MMBtu. This marks the fourth month in a row that natural gas settled below $2.00 per MMBtu… Continue Reading →

While many of us are looking forward to the official arrival of spring and sustained warmer temperatures, those in the natural gas industry are beginning to wonder where we are going to put the gas come injection season. Natural gas… Continue Reading →

As 2015 finished, the three Managing Partners at Burton Energy Group reflected on the past year and what they are looking forward to in the upcoming year. See the recent interview below. Amanda P (AP): Looking back on 2015, what… Continue Reading →

Natural gas prices continue to trade at a great bargain for consumers. For the 13th consecutive month, the natural gas contract settled below $3 per MMBtu. The February contract settled at $2.189 per MMBtu, the lowest February settlement this market… Continue Reading →

Bearish news continues to dominate the natural gas market. Last week’s natural gas storage report showed an injection of 9 Bcf, putting total storage at 4,009 Bcf as of November 20th, setting a new all-time record. Two days later, the… Continue Reading →

Mild temperatures and strong production drove the November contract to its lowest settle since 1998, rolling off the board at $2.033/MMBtu. The CY2015 NYMEX settlement is now averaging $2.706 per MMBtu, which is the lowest annual average in more than… Continue Reading →

The October 2015 natural gas contract rolled off the board at $2.563 per MMBtu on Monday. Traders pushed the contract as high as seven cents above its Friday’s close, but finally reversed and settled nearly unchanged from the previous trading… Continue Reading →

When shopping for a natural gas supplier for your home, it is advisable to review pricing from at least 3 suppliers, if not more. Keep in mind, you are getting the same product from everyone, so you do not want… Continue Reading →

In yet another unremarkable month of trading, the August 2015 Natural Gas contract closed up 6.5 cents, coming off the board at $2.886 per MMBtu. Warmer weather provided some support for the immediate term. Natural Gas continues to be range-bound,… Continue Reading →

In Georgia, only natural gas is deregulated for customers behind Atlanta Gas Light Company (AGLC) and Liberty Utilities, giving customer the power to choose their supplier/ marketer. AGLC/ Liberty are responsible for storing and distributing natural gas while marketers are… Continue Reading →